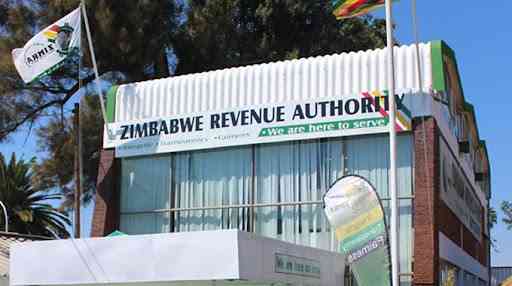

The Zimbabwe Revenue Authority (Zimra) has expressed concern over the informalisation of the retail sector saying this is posing a serious challenge to revenue collection.

Zimra commissioner general, Regina Chinamasa, said this while appearing before the budget and finance committee and submitting a bid for the 2024 national budget on Tuesday.

“One of the major revenue contributors is the retail sector. We noted the development where there is de-formalisation where the large retailers are crying foul because of theemergence of the tuckshops. The tuckshops, for us, pose a serious challenge to revenue collection,” she said.

On Monday, Industry and Commerce minister Sithembiso Nyoni accused informal retailers of creating a shadow economy and not paying taxes.

Nyoni toured wholesalers and tuckshops in downtown Harare and expressed her surprise that all prices were pegged exclusively in the greenback with a majority run by foreign nationals without proper documentation.

The sector is reserved for locals.

The reserved sectors include, transport (passenger buses, taxis and car hire services), retailing, wholesaling, hair salons, advertising agencies, estate agencies, grain milling, bakeries, tobacco grading and packaging and artisanal mining.

- Zimra seizes CCC campaign vehicle

- ZDI defends AK-47 rifles 'smugglers'

- Firearms smuggling suspect weeps in court

- Fresh calls to scrap 2% tax