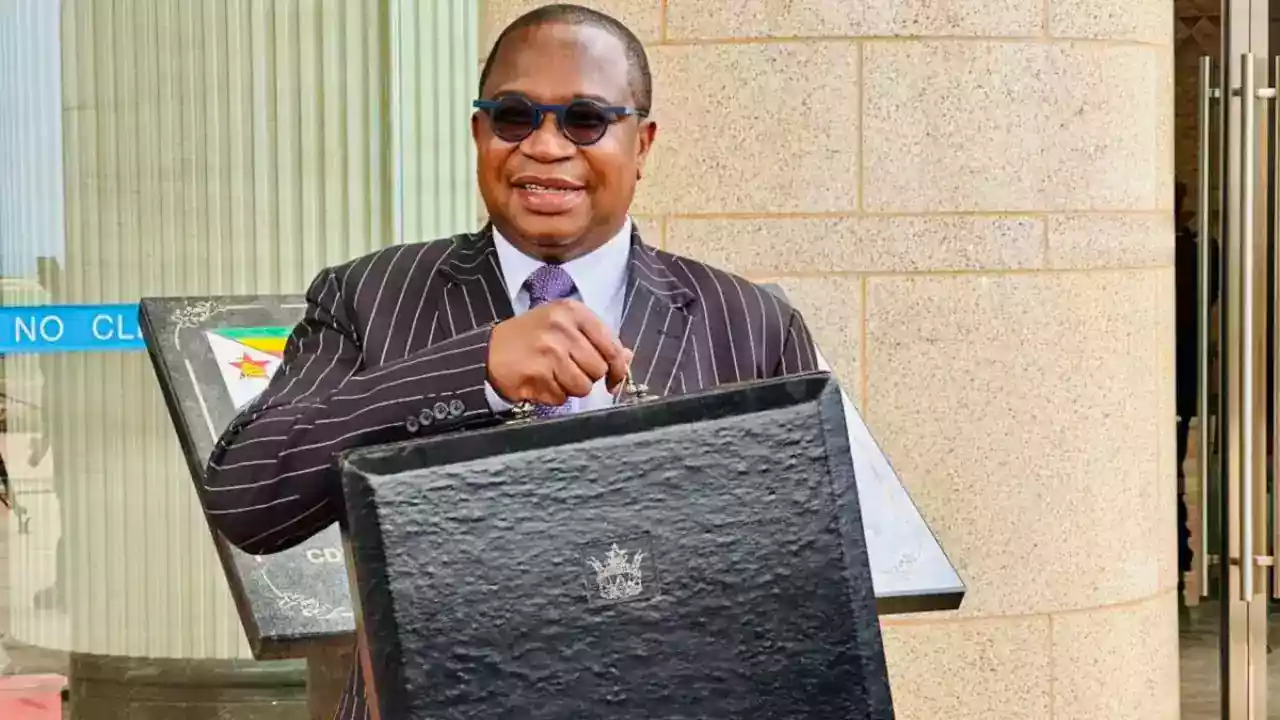

THE 2025 national budget unveiled by Finance, Economic Development and Investment Promotion minister Mthuli Ncube has sparked debate.

The raft of new tax measures introduced is as ambitious as it is controversial, aimed at stabilising government revenues and broadening the tax base.

However, the timing and nature of these proposals have raised significant concerns about their impact on an already struggling population.

The measures include taxes that touch every aspect of economic life. From a 0,5% levy on fast food items to a 10% withholding tax on sports betting winnings, a 20% plastic bag tax and a 25% tax on rental income from properties converted to business use, government has cast a wide net in its pursuit of revenue.

Excise duty on alcohol have also been increased, as well as taxation on quarry stones and income derived from non-mortgage activities by building societies.

Small businesses, such as car dealerships and hardware operators, are now required to register for taxation or face quarterly corporate tax assessments.

While government argues these measures are essential to fund infrastructure and reduce fiscal deficits, they come at a precarious time for Zimbabweans.

With unemployment at staggering levels — nine out of 10 citizens lack formal employment — the informal sector has become the backbone of the economy.

- Budget dampens workers’ hopes

- Govt issues $24 billion Covid-19 guarantees

- Letter to my People:They have no answers for Nero’s charisma

- ZMX to enhance farm profitability

Keep Reading

This sector is now squarely in the crosshairs of these new taxes, which raises questions about whether they may not inadvertently stifle the very activities that keep the economy afloat.

Consider the fast food tax, for instance. Items like pizza, French fries and hot dogs are not just indulgences but convenient and often affordable meals for those who cannot rely on inconsistent electricity or gas for cooking at home.

A 0,5% tax may seem minor, but for vendors operating on thin margins, it could drive up prices, deterring customers and shrinking profits. Similarly, the betting tax on gross winnings may appear to target luxury activities, but for many, betting represents a slim hope of supplementing meagre incomes.

The 20% tax on plastic bags reflects a commendable focus on environmental sustainability, but without affordable, widely available alternatives, its practical implementation may present challenges for both businesses and consumers.

Similarly, the increase in excise duty on alcohol is intended to curb consumption, yet it risks creating a black market for unregulated and potentially harmful substitutes.

Arguably the most significant concern lies in the 25% tax on rental income for properties converted from residential to business use.

At a time when entrepreneurship is one of the few viable paths to self-sufficiency, this tax risks discouraging small-scale enterprises that are vital to Zimbabwe’s economic resilience.

Coupled with the mandatory tax registration for small businesses, the measures might unintentionally create barriers to growth in the informal sector rather than foster its development.

Government’s rationale is clear: Zimbabwe must expand its tax base to meet growing fiscal demands. Infrastructural development and public service funding are necessary for long-term economic stability.

However, critics argue that such goals should not come at the expense of the struggling majority.

Zimbabwe’s persistent issues with corruption and mismanagement have eroded public trust and many citizens question whether these taxes will translate to tangible improvements in their lives.

At the heart of the debate is a broader question of fairness and prioritisation.

Are these taxes designed in a way that ensures equity or do they disproportionately burden those least able to pay? For many, the latter seems to be the case.

Sectors like fast food and small-scale entrepreneurship, which offer livelihoods to millions, are being taxed alongside industries with far greater capacity to absorb such levies.

To strike a balance, the government must accompany its tax measures with policies that promote economic growth and address systemic inefficiencies.

Incentivising formalisation in the informal sector, streamlining government spending and curbing corruption can go a long way in boosting revenues without overburdening the public.

For example, introducing tax breaks for small businesses that comply with registration requirements might encourage participation without imposing undue pressure.

Zimbabwe is at a crossroads. The proposed taxes could provide the much-needed lifeline to government coffers, funding essential services and infrastructure.

But if implemented without care and attention to the socio-economic realities of the population, they risk deepening inequalities and stifling the informal sector’s vital contributions.

Ultimately, the success of these measures will depend on how they are executed and whether government can rebuild trust with its citizens.

A transparent, inclusive approach that prioritises fairness and accountability is essential in navigating this challenging but necessary step towards fiscal stability.

Whether these taxes will deliver the intended results or merely add to the struggles of ordinary Zimbabweans remains to be seen.