THE dust road to Mutare stretched out before the 75-year-old Jacob Mutasa, a retired teacher from Chihera village in Betera, Buhera, under Chief Nyashanu.

He had made the 191km journey countless times during his working years, but this time it felt different.

It was a journey of sorts a desperate attempt to make his little pension stretch a little further.

The meagre sum, now paid in the increasingly devaluing Zimbabwean Gold currency (ZiG), is his only source of income.

The hope he clung to, as he stepped into the city of Mutare is quickly extinguished.

His bank card felt like mere scraps of paper in his hands.

“The network is down; we are not taking ZiG; our swipe machine is out of battery,” Mutasa recalled how he moved from one shop to another getting one excuse after another.

“At first, I thought it was really a network issue until someone in front of me asked ‘do you take USD swipe?’ and the till operator nodded in agreement. The man swiped with his USD card and pushed his trolley out of the Pick n Pay supermarket. I then asked politely ‘but you said your network is down’, then I gave her my bank card to try, but it declined. I was disappointed,” he narrated his experience.

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Bulls to charge into Zimbabwe gold stocks

- Ndiraya concerned as goals dry up

- Letters: How solar power is transforming African farms

Keep Reading

Mutasa then decided to call his nephew who works in the central business district to help him convert his ZiG to US dollars.

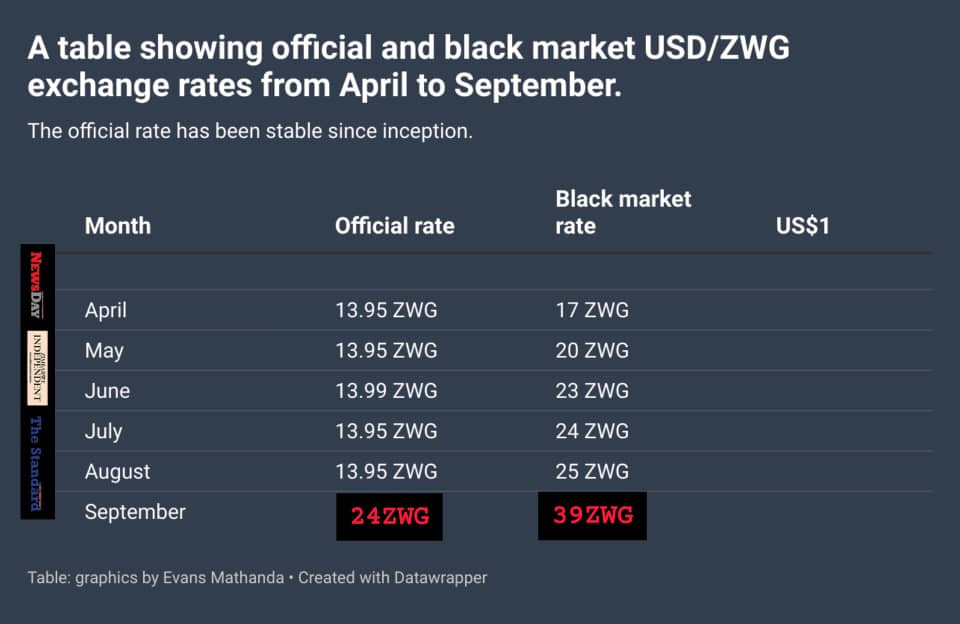

He was shocked when he learnt that the rate had gone up to US$1:ZiG30.

Investigations by NewsDay Weekender revealed that “the point-of-sale (POS) machine is not working” or “the network is down” appear to be the popular excuses being given by the majority of retail shops and fast-food outlets as they avoided transactions in the local currency.

The ZiG has tumbled on the streets over the past few days as inflation rises.

Economist Eddie Cross told NewsDay Weekender that the country needs a currency which people can have confidence in as quickly as possible, adding that it needs to be reliable as a means of exchange.

Consumer Council of Zimbabwe (CCZ) chief executive officer Rosemary Mpofu acknowledged that they knew about the non-function of ZiG swipe machines in some retail outlets which was giving consumers headaches.

“We are working on this issue as we speak. As CCZ, we are very concerned about the non-functional ZiG swipe machines and this is a serious issue,” she said.

“According to our research, most traders are not accepting ZiG swipe and if accepted, the rate will be too high, often above ZiG25 per US$1, which is an indirect way of not accepting the ZiG swipe.

“In Masvingo, OK supermarket is accepting ZWG swipe at the rate of US$1:ZiG24,80 on a few selected products like kitchen utensils and hardware equipment, but all basic goods are strictly paid for in US dollars cash only.”

In April, the Reserve Bank of Zimbabwe (RBZ) launched a new structured currency backed by gold purportedly to be the strongest in the region, as it seeks to tackle sky-high inflation and stabilise the country’s long-floundering economy.

Economist and government critic Gift Mugano said: “This is a deliberate move and a wise way of running away from the cancerous currency. The immediate solution in my view is just to do away with the ZiG and go for US dollars.

“They launched the ZiG without consultation. The market is doing its own strategy to kick out ZiG. The government should remove this ZiG and serve companies from collapsing.”

If effective fiscal and monetary policies are not enacted, Zimbabwe’s currency confusion can divide the nation.

Harare and Mashonaland provinces primarily use US dollars, while Bulawayo and Matabeleland provinces are heavily inclined to the rand.

This patchwork system emerged from a period of hyperinflation in 2008 that rendered the bearer cheques nearly worthless.

Though the Zimdollar was re-introduced in 2019, many Zimbabweans remain wary and cling to the stability of foreign currencies.

In an interview, RBZ governor John Mushayavanhu said the multi-currency system is flexible enough to allow traders to use the currency of their own choice.

“The multi-currency allows economic agents to use their currency of preference. In this regard, given the proximity to South Africa, regions such as Bulawayo Matabeleland provinces more generally utilise rand in the payment for goods and services,” Mushayavanhu said.

Mutasa’s story is not unique.

It is a reflection of the hardships faced by countless Zimbabweans struggling to survive in a country ravaged by economic turmoil.

Zimbabwe’s high inflation, coupled with inadequate pension benefits, has significantly impacted the quality of life for pensioners.

The purchasing power of pensions has eroded due to a lack of confidence in the ZiG, which makes it increasingly difficult to afford basic necessities.