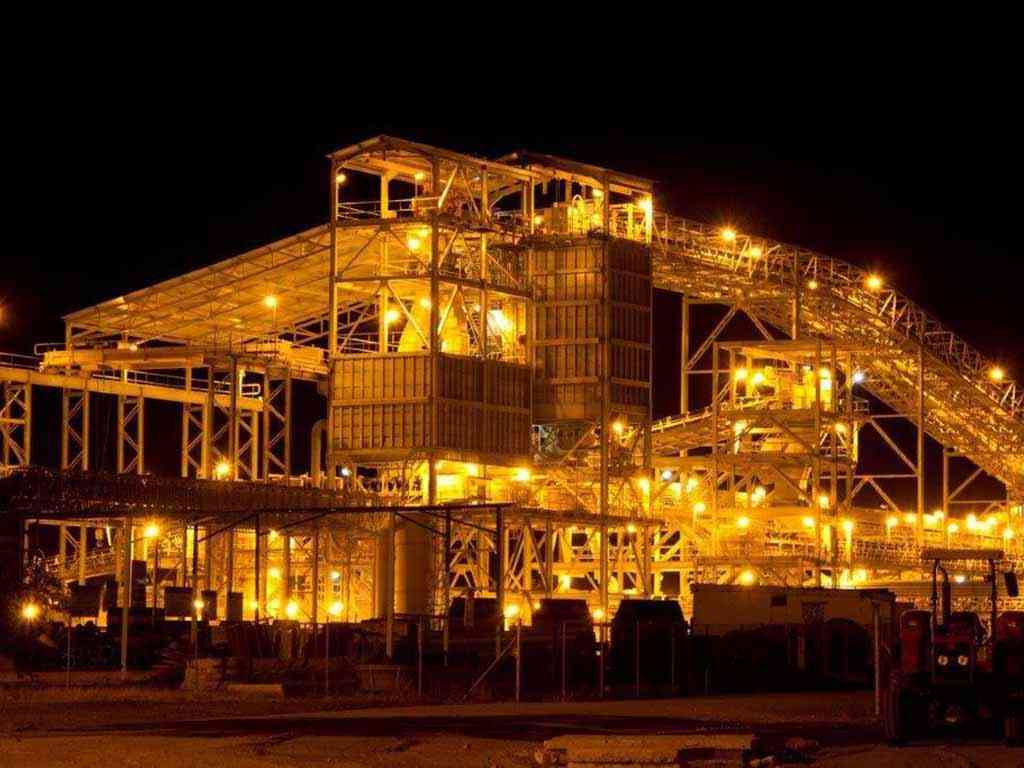

PLATINUM mining giant, Zimplats Holdings Limited (ZHL), sunk US$373,6 million into its projects and committed nearly US$479 million to expand the investments during the first quarter ended March 31, 2023.

During the quarter, ZHL spent money on exploration and expanding operations at its existing mines to scale up its mineral production.

In a quarterly update for the period ended March 31, 2023 ZHL said mined tonnage decreased by 4% from the prior quarter mainly due to a decrease in the number of operating days, from 92 in the prior quarter to 90.

The prior year’s performance, the firm explained, was impacted by lower availability of trackless mining equipment at Mupfuti Mine, which has since been addressed.

Hence, ZHL has been seeking to scale its operations to improve tonnage.

“US$2,3 million was spent on exploration drilling during the quarter and US$3,6 million was committed as at 31 March 2023,” ZHL said in a statement attached to its first quarter report for the period under review.

“The exploration activities related mainly to surface diamond drilling to upgrade the group’s mineral resources, geotechnical assessments of the rock mass properties in support of current and future mining operations in ML37 and in support of technical studies currently ongoing in ML36. A total of 21 047 metres were drilled as part of the exploration work during the quarter.”

ZHL said the development of Mupani Mine and the upgrade of Bimha Mine progressed as planned during the quarter.

- Zimplats raises expenditure on environment rehab

- Zimplats sinks US$373,6 million into projects

- Zimplats revenue down 23%

- Zimplats invests US$516m on capital projects

Keep Reading

“These projects replace Rukodzi Mine, which was depleted in FY2022, and the Ngwarati, and Mupfuti mines, which will be depleted in FY2025 and FY2028, respectively. Cumulatively, a total of US$295,3 million has been spent on these projects, with an additional US$73,5 million committed, against a project budget of US$468 million,” ZHL said.

“A total of US$4 million was spent on the Ngezi third concentrator plant during the quarter, bringing the project-to-date expenditure to US$101,1 million, with a further US$3,0 million committed as at end of the quarter, against a project budget of US$104,1 million.

“The plant operated at design production capacity throughout the quarter.”

ZHL also said that they were going through with the implementation of its US$521 million smelter expansion project and the SO2 abatement plant project which both remained on track.

“The project progressed well during the quarter. A total of US$66,6 million has been spent on the project to date, with a further US$342,5 million committed. Execution of the 35MW solar plant project at the Selous Metallurgical Complex progressed as planned during the quarter, with a total of US$0,8 million spent and US$35,8 million committed, against a budget of US$37 million,” ZHL said.

“This is the first of the project’s four project implementation phases. The final phase is scheduled for completion in FY2027, at a total project cost estimate of US$201 million. Implementation of the base metal refinery refurbishment project progressed well during the quarter. A total of US$4,6 million has been spent to date, with a further US$20,2 million committed, against a budget of US$189,9 million.”

If all the figures that were recorded as spent and committed amounts are added, respectively, the totals come to US$373,6 million and US$478,6 million.

Miners have often complained that daily power cuts and challenges in securing foreign currency have negatively impacted the firm’s ability to scale operations with ZHL being no exception.

ZHL said due to power outages in the final month of the quarter and fewer operating days, ore milled dropped 3% to 1,88 million tonnes. The miner added that the inclusion of tonnes milled at Ngezi's third concentrator plant, commissioned in September 2022, increased milled volumes year-over-year.

“6E head grade decreased by 3% from the prior quarter and was 4% lower year-on-year, largely due to an increase in tonnes milled from lower-grade stockpiles, dilution from mining across geological structures and mining larger construction excavations,” ZHL said.

ZHL reported 6E metal in final product dropped 8% from the prior quarter due to reduced 6E head grade, concentrator recoveries, and milled volumes, each of which dropped by 3%.

“Year-on-year 6E metal in final product remained at similar levels as the 10% increase in tonnes milled was offset by lower head grades and recoveries, and the prior quarter benefited from a larger release of concentrate inventory,” ZHL said.

As a result of this performance, total operating cash costs decreased by 5% from the prior quarter, mainly due to lower production volumes, to US$124,37 million. ZHL, who specialises in the platinum group metals such as platinum, palladium, rhodium, iridium, ruthenium, and osmium, is owned by South African miner, Impala Platinum Holdings Limited.