SOMETIMES I feel like Padenga Holdings is one of the few counters that analysts often forget to cover properly.

A deep dive into its historical half-year financials over the past six periods got me checking and double-checking if the numbers are what they appear to be.

In this article, we will go through how this Victoria Falls Stock Exchange (VFEX)-listed mining giant made a critical decision that changed its fortunes.

Back in 2019, Padenga was primarily a crocodile skin exporter, with operations in Zimbabwe and in the United States. It also sold the meat.

The company ran three crocodile farms in Zimbabwe - Kariba, Nyanyana and Ume, and operated Tallow Creek Ranch in the United States.

At the time, it exported over half of wet-salted crocodile skin and the company was generating revenues of over US$30 million annually.

For those those who do not know, crocodile skins are used in some of the world’s most luxurious leather products, meaning demand is highly dependent on the state of the economy.

When disposable income is high, sales of these discretionary goods surge. But during economic downturns, demand shrinks, impacting suppliers like Padenga.

- Padenga halts croc meat exports as EU tightens screws

- Eureka boosts Padenga

- ‘Zim inflation to hit 400% by Q1 2023’

- Padenga returns to profitability

Keep Reading

The outbreak of the Covid-19 pandemic posed an existential threat to Padenga’s crocodile skin business. With luxury spending poised to take a nosedive, the company needed to pivot — and fast.

Whether it was sheer foresight or well-timed strategy, Padenga made a bold move in January 2020 by acquiring a 50,1% stake in Dallaglio Investments, a company that owns two gold mines: Eureka and Pickstone Peerless.

This marked Padenga’s entry into the mining sector, a decision that would reshape its business trajectory.

Looking at it in hindsight it is easy to think that it was an easy choice, and they could not have chosen a better time to venture into gold mining operations.

It would have been fun to watch the strategy sessions to understand their thought process, which led them to venture into the mining business.

Suffice to say, gold has historically performed well in times of economic turmoil, making it a perfect hedge for a consumer discretionary business.

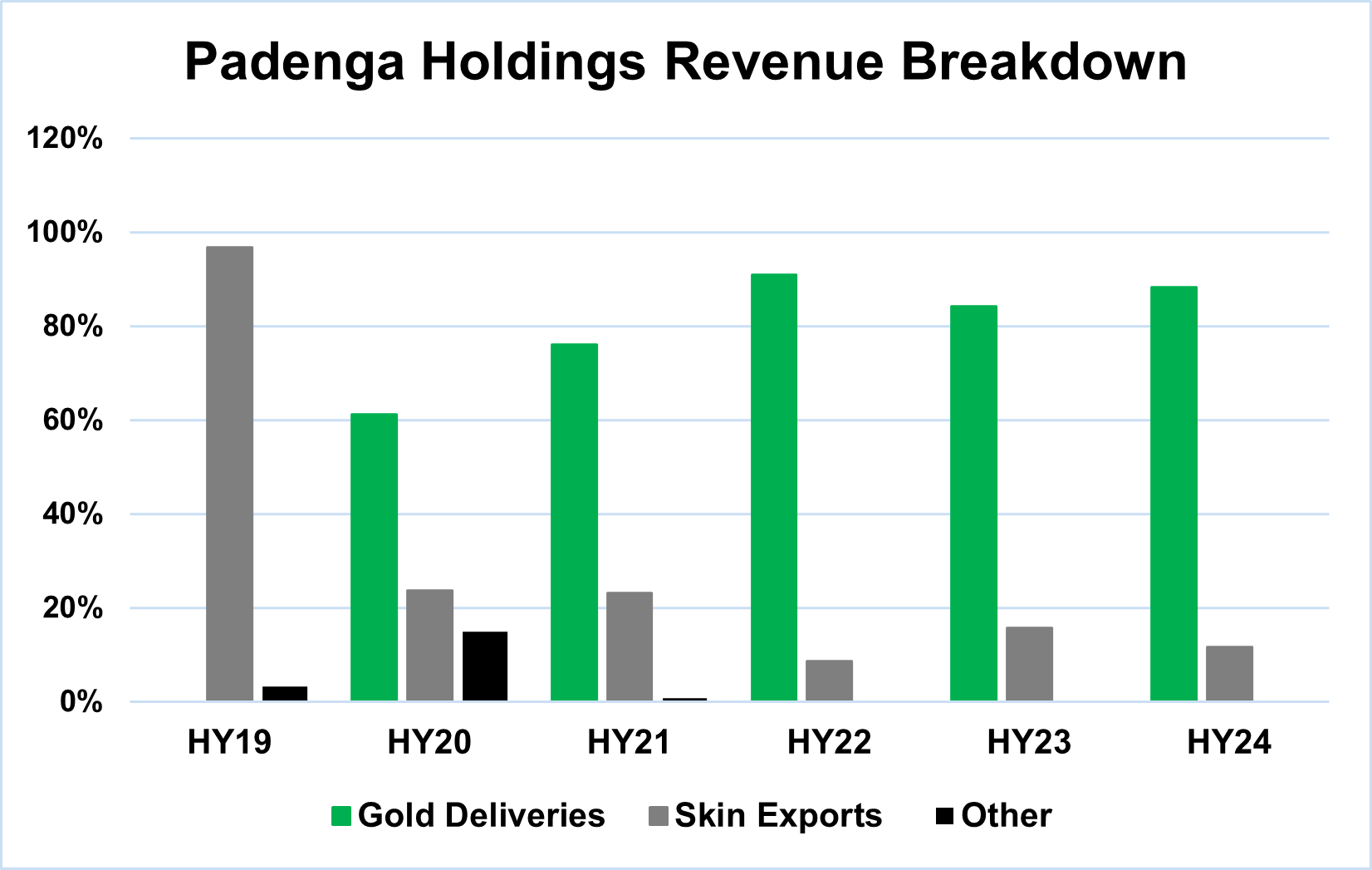

By the first half of FY20, gold had already contributed 61% to Padenga’s top line, a staggering shift for a company that, just a year earlier, had no mining revenue.

By the end of FY20, Padenga’s revenue in USD had surged by more than 140%, buoyed by the strong performance of its newly acquired mining operations.

As of the latest half-year results, gold now contributes 88% of Padenga’s total revenue, with skin exports accounting for just 12%. One has to wonder where the company would be today had it not made this strategic shift.

In 2020, when Padenga first acquired Dallaglio, the company was selling 722 kgs of gold. By mid-2024, that figure had nearly doubled, with 1 351kgs sold in just the first half of the year.

This growth is a testament to Padenga’s success in scaling its mining operations. Moreover, gold prices have performed strongly, rising from US$1 600–US$1 900 per ounce in 2020 to over US$2 700 per ounce today, further boosting revenues.

But Padenga did not just acquire Dallaglio and start generating cash. It made significant capital investments to improve production capacity, including reviving the Pickstone Peerless gold mine, which had been dormant for 44 years. This operational improvement has been key to the company's success.

In August 2023, Padenga announced its acquisition of the remaining 49,9% stake in Dallaglio, making it a wholly-owned subsidiary.

However, the latest half-year results indicate that the transaction is still pending, subject to certain conditions being met.

As a result, Padenga has effectively divided its operations into two divisions: agriculture, which includes crocodile farming and skin exports, and mining, with Dallaglio leading the charge.

The diversification strategy has undeniably boosted Padenga’s top line.

Gross profit has skyrocketed from under US$2 million in June 2019 to over US$50 million by June 2024.

Gross margins have also improved significantly, growing from 28% in 2019 to 52% in 2024.

Net profit, meanwhile, has risen from US$7 million in 2019 to US$9 million in the latest half-year results.

The company’s cash-flow generating capacity has also significantly increased over that period, sufficient to conclude that the acquisition was an accretive one.

However, this impressive financial performance has not been reflected in Padenga’s share price. In September 2021, Padenga transitioned from the Zimbabwe Stock Exchange (ZSE) to the VFEX), a move that made sense given the incentives tied to export retention for miners.

Yet, VFEX's limited trading activity has slowed price discovery, leaving the company’s true value somewhat underappreciated by the market.

Some may wonder why Padenga continues with its agriculture division when mining has become the dominant revenue driver.

The answer lies in diversification. Maintaining both sectors allows the company to balance cyclical risks. The real question now is how to optimise the concentration between these divisions, though for the moment, mining clearly leads the way.

Hozheri is an investment analyst with an interest in sharing opinions on capital markets performance, the economy and international trade, among other areas. He holds a B. Com in Finance and is progressing well with the CFA programme. — 0784 707 653 and Rufaro Hozheri is his username for all social media platforms.