MONEY Laundering is the process of disguising proceeds of crime to give them the appearance of legitimate income or wealth. It is the process of cleaning up dirty money.

Terrorist financing refers to wilful provision or collection by any means, directly or indirectly of funds with the intention that the money should be used, or in the knowledge that they are to be used, to carry out terrorist acts.

Proliferation financing refers to the act of providing funds or financial services that are used in whole or in part.

This can be for the manufacture, acquisition, possession, development, export, trans-shipment, brokering, transport, transfer, stockpiling, or use of nuclear, chemical or biological weapons and their means of delivery and related materials (including both technological and dual-use goods for non-legitimate purposes) in contravention of national laws, or, where applicable, international obligations.

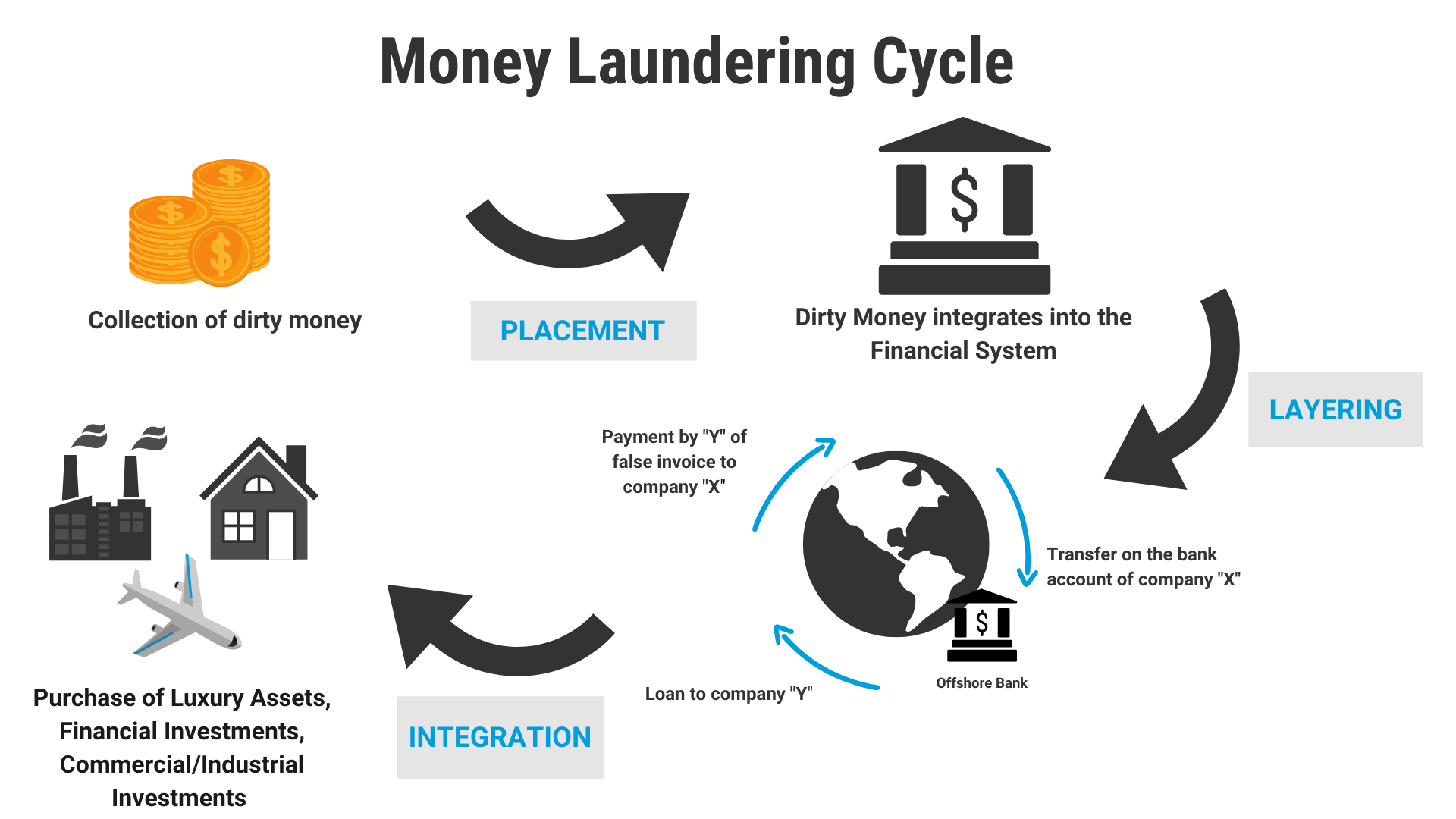

The process of money laundering

The Financial Action Task Force (FATF) is a global inter-governmental body mandated with formulating Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) Standards and enforcing compliance with the standards by the countries.

FATF has come up with a set of recommendations known as the Forty Recommendations to combat money laundering, terrorist financing, and proliferation of weapons of mass destruction.

FATF enforces compliance with the recommendations on its members and affiliate members, through a network of FATF-Style Regional Bodies (FSRBs) such as Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG), to which Zimbabwe is a member.

- New perspectives: Money laundering red flags in insurance sector

- Marry convicted of marriage fraud

- New perspectives: Money laundering red flags in insurance sector

- New perspectives: Combating money laundering in real estate

Keep Reading

One of the recommendations applicable in the insurance market is recommendation 26, which is on regulation and supervision of financial institutions.

According to this recommendation:

Supervisory authorities, in collaboration with the Financial Intelligence Unit (FIU) must adequately supervise insurers for AML/CFT purposes to assess their ability to prevent and counter such threats.

The supervisory authority should have adequate powers, including the authority to conduct on-site inspections, and to monitor and ensure compliance by insurers with requirements to prevent money laundering and the financing of terrorism.

Supervisors should be authorized to compel the production of any information from insurers that is relevant to monitoring such compliance and to impose adequate administrative sanctions for failure to comply with such requirements.

The supervisor should be provided with adequate financial, human, and technical resources to prevent or assess the insurance sector’s ability to prevent money laundering and the financing of terrorism.

The supervisor should monitor adherence by insurers with AML/CFT regulations and any guidance issued by the supervisor/FIU, as well as policies and procedures set by management.

Offences of money laundering and terrorist financing is criminalised in terms of the Money Laundering and Proceeds of Crime (MLPC) Act [Chapter 9:24].

The MLPC Act is administered by two ministers of Finance and Justice. The minister of Justice administers two Chapters, namely Chapter IV and V, whilst the minister of Finance administers the rest of the Act.

The Act of Terrorism is criminalised in terms of the Suppression of Foreign and International Terrorism (SFIT) Act, [Chapter 11:21], which is administered by the Minister of Home Affairs.

Regulations relating to freezing of terrorist assets or tainted assets were issued in terms of section 17 of the Suppression of Foreign and International Terrorism – S.I. 76 of 2014. Statutory Instrument 76 of 2014 on the implementation of the United Nations Security Council Resolutions (UNSCR) 1267, and 1373 and respective successor resolutions.

Key provisions of the Act

Section 6(2)(b) empowers competent supervisory authorities to retain amounts of civil penalties that will be levied on non-complying institutions under their purview.

Section 30 (4) requires the competent supervisor to inform FIU if;

(a) it discovers facts that could be related to ML or TF; and

(b) it appears to the supervisory authority that a financial institution of which it is the supervisory authority, or any of their respective directors, officers, or employees, is not complying or has not complied with the obligations set out in this section or the MLPC Act generally.

Role of insurance market supervisor

Recommendation 26 requires the supervisor to take all necessary steps to cooperate with the other relevant authorities.

It is recommended that the supervisor appoints within its office a contact for AML/CFT issues and to liaise with other national authorities to promote an efficient exchange of information on both trends and risks in general, policy issues and on concrete cases.

At an international level these contacts could liaise with fellow insurance supervisors to share information on trends and typologies and to deal with incidents with an international dimension.

The supervisor should establish controls and safeguards so that information exchanged by competent authorities is used only in an authorised manner, consistent with their obligations concerning privacy and data protection.

Examples of mechanisms or channels that are used to exchange information include bilateral or multilateral agreements or arrangements, memoranda of understanding, exchanges based on reciprocity, or liaison through appropriate international or regional organisations.

Recommendation 26 requires supervisory authorities to enforce AML/CFT requirements on insurers and intermediaries, including:

Performing the necessary customer due diligence (CDD) on customers, beneficial owners and beneficiaries;

Taking enhanced measures with respect to higher risk customers;

Maintaining full business and transaction records, including CDD data, for at least five years after termination of business relationship;

Monitoring for complex, unusual large transactions, or unusual patterns of transactions, that have no apparent or visible economic or lawful purpose;

Reporting suspicious transactions to the Financial Intelligence Unit;

Developing internal programmes (including training), procedures, controls and audit functions to combat money laundering and terrorist financing; and

Ensuring that their foreign branches and subsidiaries observe appropriate AML/CFT measures consistent with the home jurisdiction requirements.

Customer due diligence

Customer Due Diligence (CDD) control measures or processes are intended to ensure that the pension fund, administrator, insurer, reinsurer, broker and agent; know the identity of each customer and related third parties, understand and obtain relevant information on the type of transactions that the customer undertakes; evaluate the intended nature of the business relationship and conduct ongoing monitoring on the business relationship and transactions.

Ongoing risk monitoring, mitigation

Monitoring involves the scrutiny of activity to determine whether it is consistent with the information held relating to the customer and the nature and purpose of the business relationship.

Monitoring can be manual, automated or a combination of both.

It considers all products held by the customer and involves identifying changes to the customer risk profile (for example, the customer’s behaviour, use of products and the amount of money involved) and keeping information in relation to this up to date, which may trigger the application of enhanced CDD measures.

Not all transactions, accounts/policies/contracts, or customers will necessarily be monitored in the same way or to the same degree. Where appropriate, entities may use automated tools to monitor transactions.

Entities should define adequate thresholds or scenarios to filter out unusual transactions regarding the risk profile of a given customer.

- Zvendiya is an independent policy analyst. These weekly New Perspectives articles, published in the Zimbabwe Independent, are coordinated by Lovemore Kadenge, an independent consultant, managing consultant of Zawale Consultants (Pvt) Ltd, past president of the Zimbabwe Economics Society and past president of the Chartered Governance & Accountancy Institute in Zimbabwe. — kadenge.zes@gmail.com or +263 772 382 852.