AS Zimbabwe grapples with the fallout from a wave of collapsed Ponzi schemes and informal investment clubs, a quiet shift is taking place in the country’s financial landscape.

The spotlight is gradually turning to regulated cooperative models—particularly Savings and Credit Cooperative Societies (SACCOs)—that are offering a more structured and sustainable approach to financial inclusion.

Among the emerging players, the IAPAZ Professional Savings and Credit Cooperative Society (IAPAZ Pro SACCO) is drawing attention for its emphasis on governance, professional oversight, and member-driven services. In a market increasingly wary of unregulated schemes, such developments could mark a critical turning point for the sector.

Financial and legal analysts have long cautioned against Zimbabwe’s loosely regulated informal savings landscape.

The collapse of several high-profile schemes in recent years has left thousands of individuals out of pocket, reinforcing concerns about the lack of oversight and the vulnerability of everyday savers.

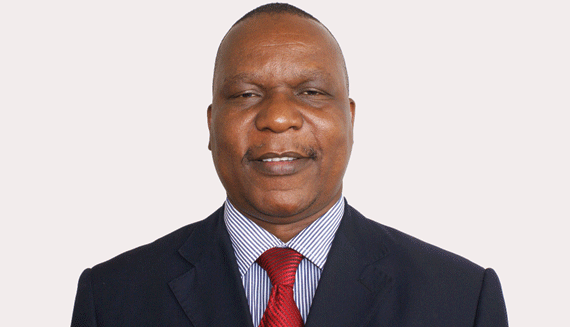

“It’s a textbook example of the consequences when regulatory frameworks lag behind public demand for financial services,” said Sibangani Chimedza, a lawyer and legal advisor to IAPAZ Pro SACCO.

“What we are seeing now is a response to that vacuum—an opportunity for structured, member-owned institutions to step up.”

Founded by professionals from diverse sectors, IAPAZ Pro SACCO operates under the Cooperative Societies Act, and has filed governance instruments in place—a key difference from informal clubs and speculative investment groups.

- Techurate commits to unlocking growth for SACCOs

- Govt revives stalled Binga-Karoi Road project

- Govt demands timeous returns on rehab funds

- Bus route wars: Government engages operators

Keep Reading

The SACCO’s formal compliance and its focus on long-term member value appear to be resonating with stakeholders seeking viable alternatives.

One of the SACCO’s most ambitious moves to date is its upcoming study tour to Kenya, scheduled for June 22–30, 2025. Kenya’s SACCO sector is widely regarded as one of the most advanced in Africa, having successfully aligned grassroots cooperative models with national development goals and modern financial infrastructure.

“Kenya has demonstrated that cooperatives can bridge the gap between formal finance and underserved communities,” Chimedza added.

“If Zimbabwean institutions can learn from that success and adapt those strategies to our local realities, it could be transformative.”

The IAPAZ Pro SACCO delegation plans to engage with Kenya’s SACCO Societies Regulatory Authority (SASRA), cooperative banks, and leading fintech innovators.

Observers suggest the tour signals more than a search for operational best practices—it hints at aspirations to broaden the cooperative’s service offerings into areas like digital finance, health insurance, and agricultural lending.

Preliminary information suggests IAPAZ Pro SACCO is aiming well beyond traditional savings and loans. Planned initiatives include: Integrated loan products bundled with business development support, affordable housing finance tailored to local market conditions and financial literacy programs to address the knowledge gaps often exploited by scams

Analysts say such a multifaceted approach may be what sets sustainable SACCOs apart from the high-risk alternatives that have burned many Zimbabwean savers.

“This isn’t just about collecting members’ deposits,” said Chimedza.

“It’s about building financial resilience. When cooperatives are designed around education, transparency, and long-term service to members, they become much more than lending institutions—they become pillars of economic empowerment.”

Despite these promising developments, the road ahead for Zimbabwe’s cooperative finance sector is not without hurdles. Public skepticism, economic volatility, and the need for technological investment remain key concerns. Yet, many believe the current environment—characterized by widespread disillusionment with informal schemes—may present a unique window of opportunity for SACCOs to gain ground.

“The real test will be whether these cooperatives can maintain strong governance while expanding,” Chimedza cautioned. “There’s always the risk that rapid growth can outpace systems. But early signs indicate that some institutions, like IAPAZ Pro SACCO, are laying the right foundations.”

For many Zimbabweans still reeling from financial losses, the emergence of regulated, professional cooperatives could represent a long-overdue shift toward safer and more inclusive financial models.

“I lost money in one of those fake schemes,” said a Harare-based teacher who preferred to remain anonymous.

“Now, I’m just looking for a place where I can save and plan for the future. Maybe this time we’re building something real.”