ZIMBABWE'S equity markets present a paradox. While indices show recovery, many blue-chip stocks remain significantly undervalued, creating what analysts describe as prime buying opportunities ahead of an anticipated liquidity surge.

The Zimbabwe Stock Exchange (ZSE) staged a 3% rebound in May, reversing March’s 7% slump, with trading volumes more than doubling to ZiG601 million.

Yet beneath these headline figures, Fincent Securities reveals a market still trading at discounts to historical valuations.

“Many major counters are still trading below their historical averages, presenting attractive buying opportunities for investors,” said Fincent in its May market review.

“We believe equities remain undervalued and will gradually reprice as liquidity improves. Market data reveals intriguing divergences.”

The All-Share Index gained 2,55%, powered by medium caps, turnover leapt from ZiG268 million to ZiG601 million month-on-month.

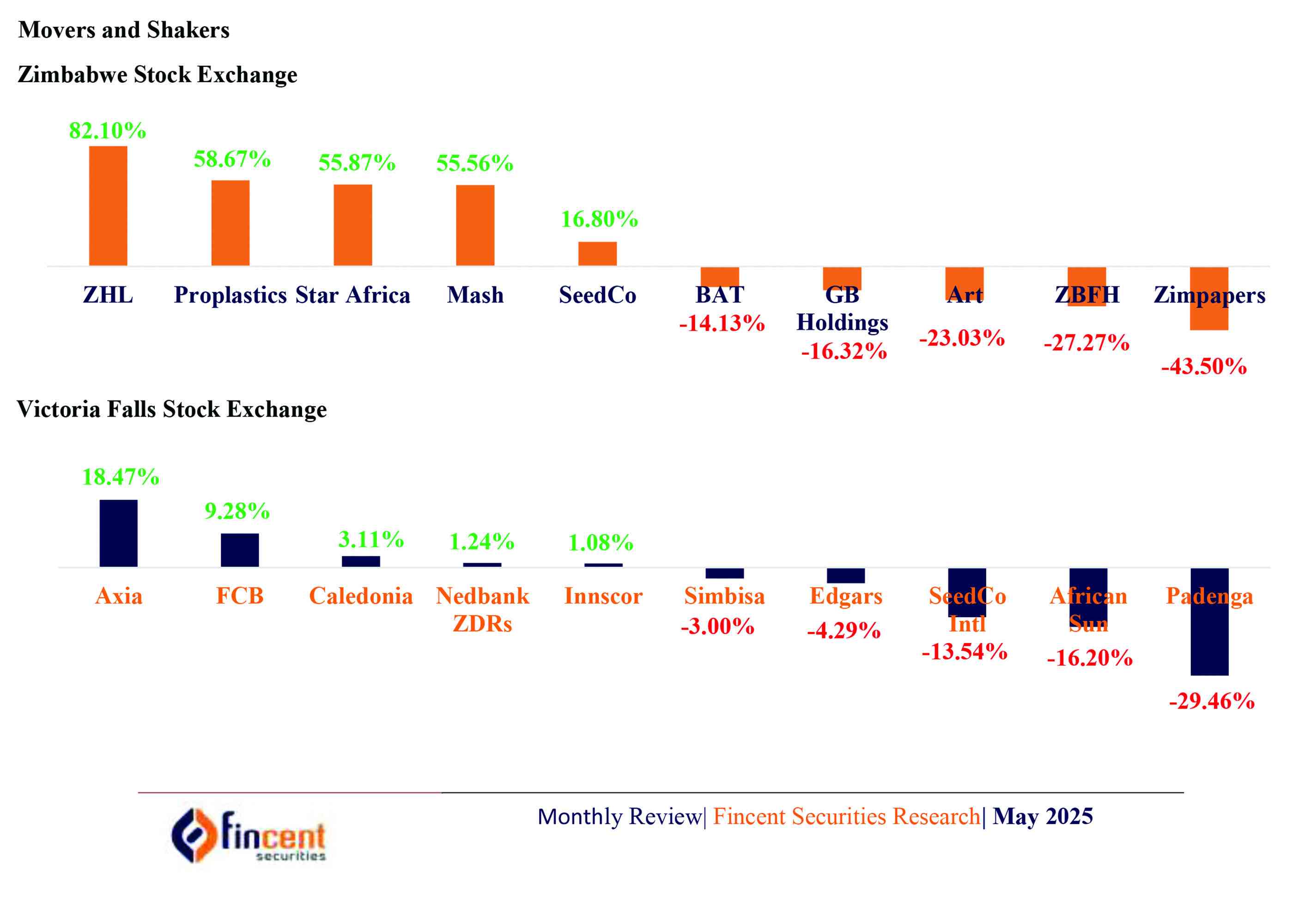

Econet dominated trades at ZiG356 million, tripling its April activity, followed by Delta. Zimre Holdings Limited emerged as May’s top performer on the ZSE, soaring by 82,10%, while Zimpapers suffered the largest loss, falling by 43,50%.

The Victoria Falls Stock Exchange told a different story, with the market cap dropping 6% after April’s 9,39% gain. Padenga led decliners as monthly turnover dipped to US$3,7 million.

- Inaugural Zim investor indaba highlights

- Stop clinging to decaying state firms

- ZB explores options to tackle inflation

- Zim operations drive FMB Capital

Keep Reading

Morgan & Co’s senior analyst Tafara Mtutu identified three key drivers behind the ZSE rebound: Econet’s strong financial year 2025 outlook, Mashonaland Holdings’ valuation catch-up, and positioning ahead of SeedCo's anticipated results.

“I think what really underlined those movements were to do with the fundamental stories for all these companies,” he noted.

“We expected Econet to outperform and to do very well in its financial year 2025 and that has been affirmed by the results that they published over the weekend.

“Masholds was another undervalued stock and as when the month of May started it was undervalued and it has exhausted that upside. It exhausted that upside throughout the month of May so it was one of the top performers.”

He added: “I would like to believe that people expect some good results in Seedco Ltd and I think they are actually taking positions on that stock and they have been doing so throughout the month of May and that’s why it also moved upwards.”

The analyst expects current tight monetary policy to persist through 2025, but sees potential catalysts.

“I don’t see the central bank easing its current monetary policy stance and I don’t think there will be any expansionary fiscal policies in play. So, I think what we are seeing right now will likely persist throughout the end of the year,” Mtutu said.

“But we would likely start to see a bit of maybe more activity on the stock market on the back of increased inflows from the mining sector as well as ripple effects of a better agricultural season that we are having this year. But that won’t be big enough to result in a volatile exchange like we saw in years past.”

l Exchange rate as at May 30, 2025: US$1: ZiG26,9