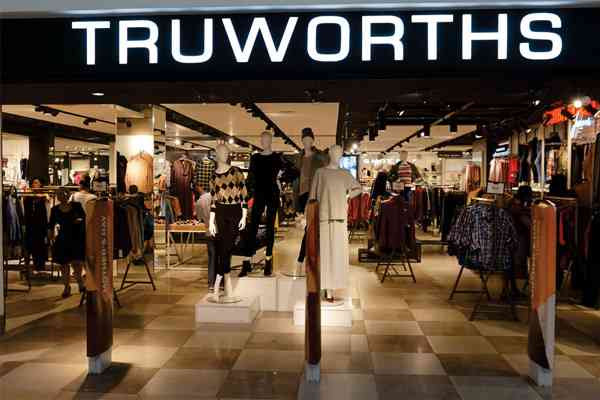

HARARE – Truworths, once a high-end clothing retailer with over 100 branches across Zimbabwe, is being sold for just one dollar after going insolvent. The company’s downfall reflects the deep crisis in Zimbabwe’s retail sector—one that has been decades in the making.

A rescue plan by administrator Oliver Mutasa of Crowe Advisory lays bare the extent of the damage. Truworths now has a negative net asset value of US$2 million, meaning it owes more than it owns. Its biggest debts? Unpaid wages and outstanding payments to suppliers.

A small clothing manufacturer, Valfin, is stepping in to try and revive the brand. Valfin will pay a dollar for the company, then invest US$2 million to recapitalise it. First Mutual Microfinance will take over Truworths’ debtors’ book for another US$2 million.

As part of the deal, Truworths’ management will take over Bravette, the company’s manufacturing arm, as payment for what they are owed. A creditors’ schedule reveals the company owes executives over US$560,000, managers US$624,000, and other workers US$444,000.

At its peak in 2001, Truworths had 101 stores. Today, only 26 remain.

How did Truworths collapse? Truworths’ decline did not happen overnight. According to Crowe Advisory, the company’s troubles stretch back decades.

The slow death of Zimbabwe’s textile industry

For years, Truworths and other retailers relied on a once-thriving local textile sector. Companies like David Whitehead Textiles and Cone Textiles provided high-quality fabric to Zimbabwean manufacturers, who then supplied retailers such as Truworths, Edgars, Barbours, and Greatermans.

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Bulls to charge into Zimbabwe gold stocks

- Ndiraya concerned as goals dry up

- Letters: How solar power is transforming African farms

Keep Reading

But this ecosystem collapsed over 30 years ago, forcing retailers to import fabric and finished products, which required USD upfront.

“The diminishing supplier base in the country left the group with no option but to import raw materials and finished products, which requires upfront funding in USD and longer delivery times.”

Truworths operated on a credit-heavy business model—85% of its sales were on credit—leading to cashflow shortages. This cycle resulted in store closures and chronic understocking.

“Barbours and Greatermans, both historic players in the retail industry, also faced steep declines. Once considered luxury and mid-tier department stores, they were also impacted by the collapse of the manufacturing sector and declining disposable incomes,” Crowe says.

Government policies that made things worse

Over the years, government decisions only deepened the crisis.

In the 2000s, the government allowed cheaper textile imports, undercutting local manufacturers. Truworths responded by launching Number 1 Stores, a budget chain, but it wasn’t enough. In 2022, desperate to tame inflation, the government suspended all lending. This meant credit-driven businesses like Truworths “no longer made sense”, according to Crowe.

At the same time, interest rates on local currency loans soared to 200%, further crippling the business.

A further example of how government policies decimated business came in 2023; Truworths raised fresh capital from shareholders, but by the time the funds were secured, the money was half its value due to the Zimdollar’s depreciation.

COVID’s final blow

The pandemic disrupted global supply chains, making it even harder for retailers like Truworths, Edgars, and Powersales to source materials and stock. Transport restrictions and lockdowns added more pressure, pushing many retailers into survival mode.

Cheap Imports and the informal market

Retailers just can’t compete with cheap imports and the unregulated informal market.

“There are laws that ban the importation of second-hand clothes, but the authorities do not enforce them. Competition from the informal sector is not subject to similar regulatory compliance requirements.”

What happens next?

Valfin’s US$2 million injection will go towards restocking, renovating stores, and upgrading Truworths’ retail management system. Truworths will then delist from the Zimbabwe Stock Exchange, where it has been listed since 1981. – newZWire