ZIMBABWE’S banking sector has witnessed a significant boost in confidence, with foreign currency deposits surging 13% to US$2,64 billion in October 2024, compared to the same period last year, a central bank official said yesterday.

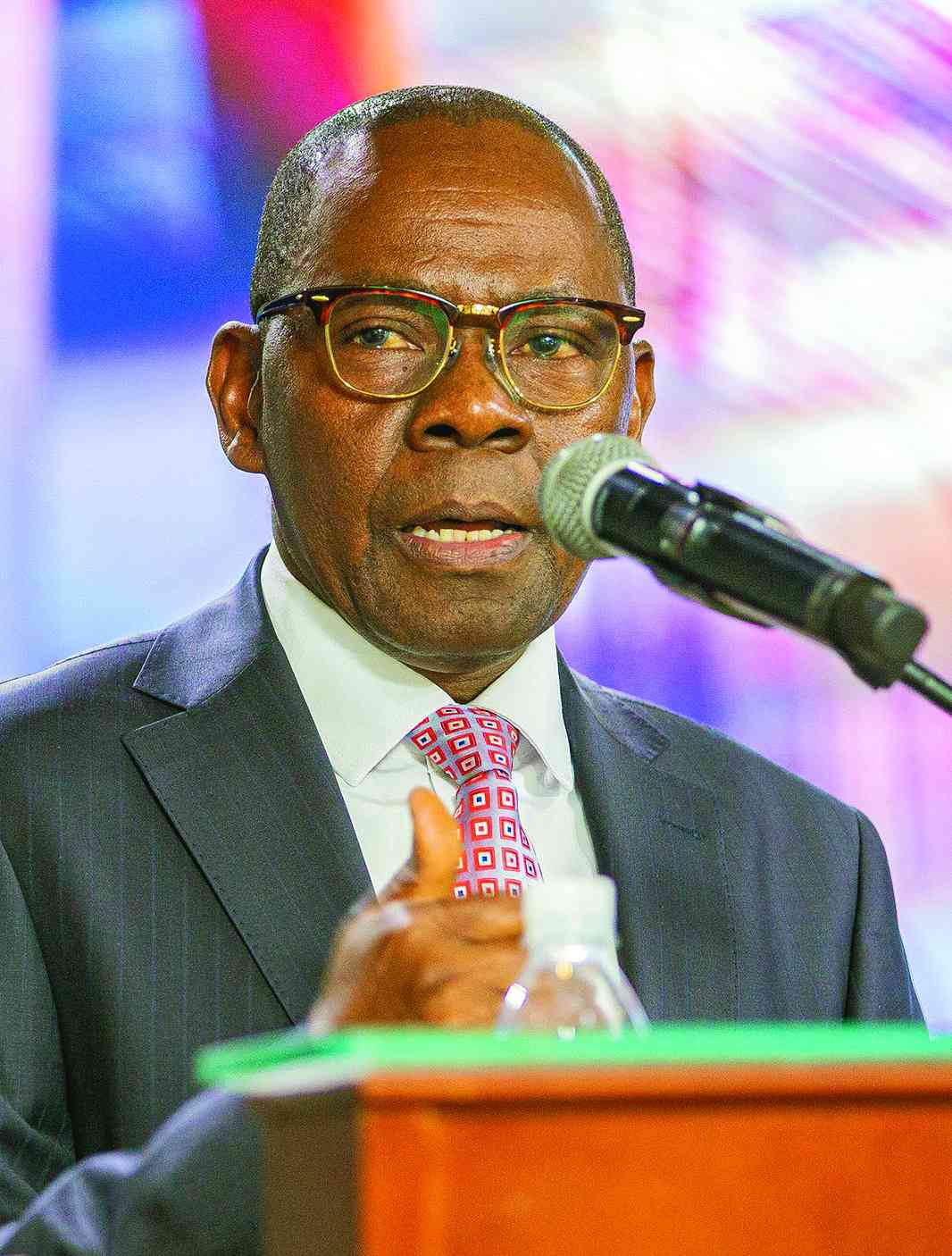

Innocent Matshe, deputy governor of the Reserve Bank of Zimbabwe (RBZ), who spoke at the 2024 Banks & Banking Survey and awards breakfast in Harare, said the sector remained resilient under a difficult environment.

Running under the theme “Weaving Through a Dynamic Liquidity Terrain in Zimbabwe”, the survey is published by the country’s biggest business weekly, the Zimbabwe Independent, in partnership with First Capital Bank — the Victoria Falls Stock Exchange-listed financial services outfit.

“Confidence in the banking sector improved significantly as depicted by growth in foreign currency deposits from around US$2,33 billion in October 2023 to US$2,64 billion as of end October 2024,” Matshe, who presented a paper under the topic Weaving Through a Dynamic Liquidity Terrain Insights on the State of Banking Industry and Liquidity Landscape for 2025, said.

“Foreign currency-denominated loans constituted approximately 88,39% of total banking sector loans and advances. This skew towards foreign currency-denominated loans reflects the substantial demand for US dollar-lending, which can heighten exposure to credit risk.

“The (Reserve) Bank will continue to put in place measures to support the banking sector’s resilience, integrity and profitability consistent with its twin mandates of fostering price and financial system stability.”

The deputy governor said the apex bank would continue to maintain adequate liquidity in the sector, which is essential for economic stability and growth.

In the outlook period, given that inflation remained high, Matshe said the central bank would maintain tight liquidity conditions — a stance that monetary authorities have maintained for a long time, as they work to stabilise the economy.

- Zim banks under siege

- In Conversation With Trevor: ‘Zimbabwe offers great opportunities’- Ciaran Brian McSharry

- Zim banks under siege

- Zim banks optimistic as capital deadline approaches

Keep Reading

He said the banking sector should come up with instruments to deepen the financial markets, thereby providing more liquidity.

“Overall, the Reserve Bank remains committed to ensure that the economy is well oiled and that all excess liquidity is sterilised,” Matshe noted.

“The banking sector continues to demonstrate resilience and stability, as reflected by adequate capital levels, satisfactory asset quality metrics, stable liquidity and sustained profitability.

“The indicators also compare favourably to the previous quarter and international benchmarks.”

He said Zimbabwe’s banking sector continued to maintain strong liquidity positions, reflected by an average prudential liquidity ratio of 57,54% as of September 30, 2024.

All banking institutions, except one, were compliant with the minimum prudential liquidity ratio of 30%, the RBZ boss told delegates at the ceremony, which was attended by a cross section of banking industry executives.

He said the central bank was actively managing liquidity conditions in the market through market-based instruments and regular meetings of the liquidity management committee.

“To enhance liquidity management and smoothen clearing and settlement processes the Reserve Bank recently introduced intra-day facilities in November 2024,” Matshe said.

“Additional liquidity management measures include foreign currency operations to meet pipeline demand, a targeted finance facility for agriculture, statutory reserve requirements and open market operations. The Reserve Bank is also supporting compliance on anti-money laundering and the Basel III framework, reflecting international best practice.”

To enhance liquidity conditions, the RBZ expects deposit taking institutions to participate more actively in the interbank money market and interbank foreign exchange market.

“Therefore, the Reserve Bank always endeavours to balance the need for liquidity for the smooth functioning of the banking sector,” the deputy governor said.

Out of 19 operating banking institutions, only one, is experiencing liquidity challenges and is currently operating under a corrective order issued on April 2.

He said the central bank was closely monitoring the bank’s condition and performance as corrective measures were being implemented by shareholders.

As of September 30, 2024, all banking institutions, including the one operating under a corrective order, were adequately capitalised, Matshe said. The average capital adequacy and Tier 1 ratios for the banking sector were 37,0% and 32,4%, respectively.

He, however, noted that credit risk in the banking sector remained low, albeit with a marginal deterioration in the aggregate non-performing loans to total loans ratio, which stood at 3,2% as at September 30, 2024.