For many Zimbabwean investors, real estate has long been the go-to asset class, offering tangible value and historical stability in local markets.

However, as the global economy evolves, opportunities to diversify investment portfolios beyond real estate are becoming increasingly accessible.

One such opportunity lies in the U.S. stock market, particularly through the Invesco QQQ Trust (QQQ) ETF, which tracks the Nasdaq-100 Index—a benchmark for the world’s leading technology and growth companies.

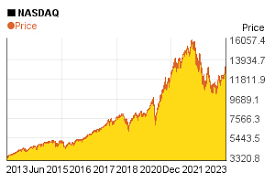

The Nasdaq-100’s remarkable journey: 2005–2024

Over the past two decades, the Nasdaq-100 Index has demonstrated impressive growth, albeit with periods of volatility.

From 2005 to 2024, the index has weathered economic storms and capitalized on technological advancements, delivering an cumulative return of about +459.145 over the past 10 years versus 262.97% for S&P 500 over the same period.

As a disclaimer, I own a few shares for QQQ ETF so this is not a recommendation to buy or sell this security.

It's important to remember that past performance does not guarantee future trends.I simply use the past as part of my research process and include many other factors such as future outlook and earnings growth potential for stocks that are part of the particular ETF.

- Metallon partners American firm, to list on the Nasdaq

- Using expert advisors to trade on markets

- The Markets Mirror: Unlocking the US stock markets for Zim traders

- Nasdaq's fourth-quarter profit rises on fintech strength

Keep Reading

Narrative explanation for the QQQ historical performance

2005–2006: Modest gains of 1.2% and 6.8% as the market recovered from the dot-com bubble burst.

2007–2008: An 18.7% gain in 2007 was followed by a sharp 41.9% drop in 2008 during the global financial crisis.

2009–2013: A strong rebound, with a 53.8% surge in 2009 and consistent positive-digit growth, driven by tech innovation.

2019–2022: Accelerated growth during the epidemic (37.83% in 2020) but a significant correction in 2022 (-33.07%) due to rising interest rates.

2023–2024: Recovery and growth, with returns of 53.79% and 24.84%, fueled by advancements in artificial intelligence (AI) and cloud computing.

Why QQQ? Opportunities for Zimbabwean investors

The Invesco QQQ ETF offers Zimbabwean investors a gateway to the US tech market without the need to purchase individual stocks. Here’s how Zimbabweans can access QQQ and why it might be worth considering:

How to invest in QQQ from Zimbabwe

- International brokers: Zimbabwean investors can open accounts with global brokerage platforms which accept international clients.

- Local brokers: Some Zimbabwean brokers with partnerships with international exchanges may also facilitate access to the US-listed ETFs like QQQ.

- Dollar diversification: Investing in QQQ provides exposure to the U.S. dollar, which can act as a hedge against local currency volatility.

Benefits of QQQ

Diversification: While tech-heavy, QQQ includes 100 of the largest non-financial companies, offering exposure to a range of sectors like consumer discretionary and healthcare.

Liquidity: As one of the most traded ETFs, QQQ allows for easy entry and exit from positions.

Growth potential: The Nasdaq-100’s historical performance underscores its potential for long-term growth, driven by global tech leaders like Apple, Microsoft, and Amazon.

Risks to consider

Volatility: The tech sector is prone to sharp price swings, as seen during the 2008 financial crisis and the 2022 market correction.

Sector concentration: Heavy reliance on tech means sector-specific challenges can significantly impact performance. In my portfolio, I prefer being overweight on Exchange Traded Funds (ETFs) that track the S&P 500 Index rather than Nasdaq because it's relatively broadly diversified.

Currency risk: Fluctuations in the Zimbabwean ZiG against the U.S. dollar could affect returns.

Strategic considerations for Zimbabwean investors

For those looking to diversify beyond real estate, here are some key strategies:

- Balanced portfolio: Combine QQQ with local real estate, other international equities, or fixed-income assets to mitigate risk.

- Risk management: Limit exposure to tech stocks by sizing positions appropriately and setting stop-loss orders. If you want more insights on this, book a paid consultation with me via www.streetwiseeconomics.com.

- Long-term perspective: Tech investments are best suited for long-term growth, given the sector’s cyclical nature.

- Stay informed: Keep abreast of U.S. market trends, tech developments, and global economic factors that could impact the Nasdaq-100.

While real estate remains a cornerstone of Zimbabwean investment strategies, the Nasdaq-100—accessed through the QQQ ETF—presents a compelling opportunity to diversify into global markets.

By tapping into the growth of leading tech companies, Zimbabwean investors can potentially enhance their portfolios and hedge against local economic uncertainties.

However, as with any investment, careful consideration of risks and a well-rounded strategy are essential to navigating the complexities of international markets. As the world becomes increasingly interconnected, the ability to invest beyond borders offers Zimbabweans a chance to participate in the global economy’s most dynamic sectors.

The QQQ ETF is one such avenue, blending growth potential with the convenience of a diversified, liquid investment vehicle.

- *Isaac Jonas is a Canada-based economist and principal consultant at Streetwise Economics. He is also a retail investor, retail trader and content creator, focusing mainly on the US and Canadian capital markets. He regularly shares insights via his social media handles and YouTube channel (Streetwise Economics). His website is www.streetwiseeconomics.com and can be reachable on isacjonasi@gmail.com. Insights shared in this article are based on current market conditions, which may be subject to change, hence this article does not amount to investment advice.