A comprehensive report on global lithium developments has ranked Zimbabwe among the biggest global producers in the coming years.

In a new research, Fitch Solution, the global advisory, said shipments from Zimbabwe would be crucial in propelling growth in the world’s electric (EVs) market, which is projected to reach US$869 billion by 2031.

Zimbabwe is one of only two African countries included in the worldwide report titled ‘Lithium, Keeping an Ion Global Trends, Risks, Opportunities in a Supercharged Market’.

The other is the Democratic Republic of Congo, Harare’s southern African peer.

Fitch said even though Zimbabwe’s lithium mines were still mostly at exploration stage, the country’s output would have a significant bearing on trends worldwide.

Data released by Fitch showed Zimbabwe is among 15 economies globally, which are currently developing lithium mines, with a projected market share of about 5% around 2031.

The data show market share would remain around the same rates, mostly because the world’s biggest economies are also developing their own lithium assets.

These include Chile, Brazil, Australia and Argentina, according to the report.

- In Full: Fifteenth post-cabinet press briefing, June 07, 2022

- Health talk: Mandatory wearing of masks can now be scrapped

- Zipra cries foul over vetting process

- Global agency downgrades Zimbabwe’s growth projections

Keep Reading

“Amid rising interest, government support and increasing capital dedicated towards lithium projects, a notable number of new lithium-producing markets will emerge and altogether account for a large share of global output,” Fitch said.

“These include mostly developed markets (DMs) such as the US, Canada, Germany and some other European markets, along with developing markets such as Serbia and Zimbabwe.”

It noted that there has already been a few shipments of samples from Zimbabwe, saying “the country does produce some lithium currently”.

“We note particular upside in Canada and the US due to expanding policy support for critical minerals projects,” the paper said.

It forecast global lithium production to nearly quadruple between this year and 2031.

“The upcoming boom in energy storage, dominantly driven by the EV revolution, will be the growth engine behind the lithium upstream sector,” Fitch said.

“We base our lithium demand expectations on our autos team’s EV sales forecasts and see annual lithium consumption for the EV sector almost tripling over 2022-2031, while annual EV sales will grow from 11,4 million to 30,3 million units.”

Last week, Shanghai Stock Exchange-listed battery maker, Huayou Cobalt, said it would ship its first output from Arcadia Mine near Harare into the global markets early next year, becoming the first of at least four firms at various stages of developing operations to export the mineral.

The firm has already signed offtake deals with Chinese markets where its samples have already been accepted.

Huayou entered the market in the final quarter of 2021 after taking over stocks previously controlled by Australia headquartered Prospect Resources in a US$378 million deal.

The firm will be pouring US$300 million to kick start the mine with an estimated 15 year lifespan.

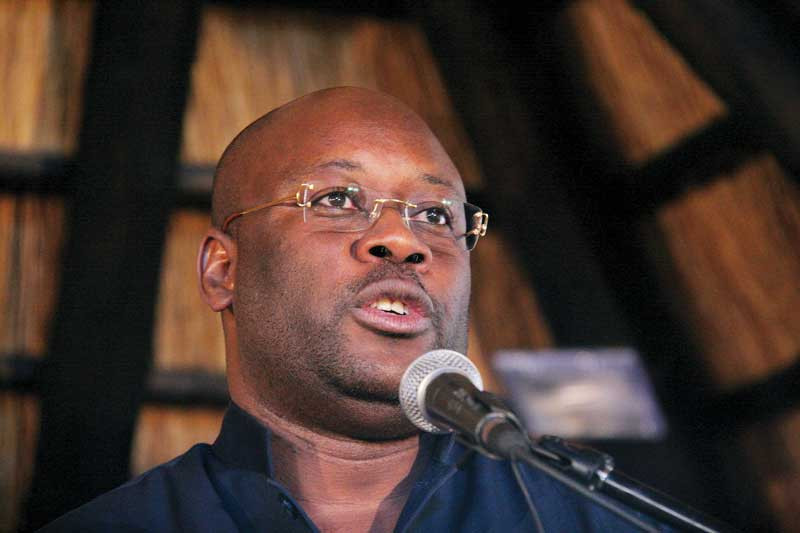

George Togara, projects manager at Arcadia, told reporters at the mine last week that construction of a 400 000 tonne capacity plant was half way through and completion was set for the end of this year.

“We are targeting to complete our project by the end of the year so that we start commissioning and production during the first quarter of 2023,” Togara told reporters said at the mine in Goromonzi.

“Looking at the scale of production that we are going to have, Zimbabwe will be the biggest producer of lithium products in Africa. As we start production we are mainly targeting two primary products which are petalite, which is used in the ceramic industry and spodumene which is used in the battery making industry.”

In its report, Fitch said: “The sharp acceleration in demand for lithium-ion batteries will outpace supply growth in the medium term, keeping prices elevated.

“We forecast Chinese lithium carbonate 99,5% to average US$68 000/tonne in 2022 and US$55 000/tonne in 2023”.