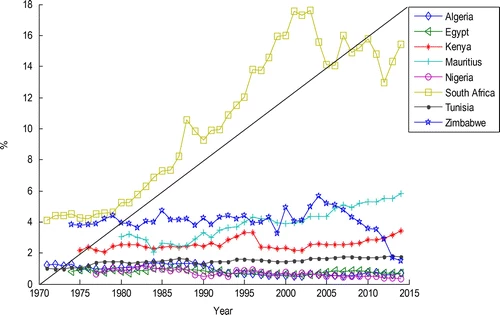

Zimbabwe’s insurance penetration rate — defined as the ratio of insurance premiums to gross domestic product — remained low at approximately 2% in 2024. This figure, cited in the 2024 annual report of the Insurance and Pensions Commission (Ipec), is not only below the global average of 6%, but also trails the Sub-Saharan Africa average of 2,8%.

“Of notable concern is the insurance penetration rate, which remained low at about 2% in 2024, below the global average of 6% and Sub-Saharan Africa average of 2,8%.” Ipec said.

This persistent underperformance invites critical reflection. Is the issue rooted in a lack of innovation within the insurance sector? Is Zimbabwe’s economic environment too volatile for the industry to thrive? Or could the limited number of market participants be failing to unlock broader consumer engagement?

According to the same report, the number of registered insurance and reinsurance companies was as follows:

l Short-term insurance companies were 20;

l Microinsurance companies were 16;

l Reinsurance companies were 10;

l Funeral assurers were seven;

- UK based Zimbabwean divorces wife of 33 years over conjugal rights

- New perspectives: Role of private sector in resource mobilisation

- New perspectives: Money laundering red flags in insurance sector

- 3 000 non-resident pensioners owed US$1.5 million, says Ipec

Keep Reading

l Life insurance companies were 12; and

l Life reinsurers were four.

While these figures suggest a structured market, they may also point to missed opportunities in competition, segmentation, and product differentiation.

In a nation where risk exposure is high and economic safety nets are limited, insurance should serve as a buffer — yet too many Zimbabweans remain uninsured.

A key to unlocking growth lies in innovation, product development, and most critically, the integration of actuarial expertise. Actuaries play a pivotal role not only in pricing, but in crafting solutions that respond to the specific needs of the market — ensuring accessibility, sustainability, and regulatory compliance.

The Ipec licensing checklist for insurers (2022), available on the commission’s website, underscores the importance of actuarial input in the licensing process. New entrants, among other requirements, are required to submit:

l Actuarial statements validating the soundness of proposed business;

l Product pricing justifications and performance projections;

l Assumptions on inflation, interest rates, and reserves; and

l Comprehensive policy samples and operational manuals.

This points to a broader truth: actuaries are central to insurance development — not only for regulatory approval, but also for building public trust and long term market stability.

At African Actuarial Consultants, we offer actuarial support across the insurance value chain — from registration to product development and pricing. Our team works with both new entrants and established providers to ensure actuarially sound, market aligned offerings that contribute to greater insurance penetration.

For Zimbabwe to bridge the insurance gap, the industry must embrace deeper expertise, bolder innovation, and broader inclusion. This is not just a matter of market share — it is a national imperative.

Maeresera, FIA C.Act, ACCA, CIA, is general manager and consulting at African Actuarial Consultants. — ckondenga@aaczim.co.zw; ckondenga@gmail.com; info@africanactuarialconsultants.com; Tel: +263 (242) 884 140/9.