SHAMVA Gold Mine, a subsidiary of Kuvimba Mining House (KMH), has pivoted to a modular development plan for its US$200 million open pit project, as the miner seeks to lower the capital burden while maintaining expansion potential.

In mining, a “modular plan” refers to a pre-engineered system where mineral recovery or processing is broken down into individual, prefabricated units (modules) that can be assembled and adapted on-site. This approach offers advantages such as faster implementation, flexibility, and potential cost savings compared to traditional, one-off construction methods.

The plan, according to Shamva Gold Mine general manager Gift Mapakame, offers investors a more manageable risk reward profile amid volatile market conditions.

“The Shamva Hill project has grown in scale following price-driven re-optimisation,” he told businessdigest in an interview.

“Initial feasibility studies indicated a peak funding requirement exceeding US$127 million, with total funding, including stay in business capital, reaching close to US$200 million over the project’s tenure.”

Mapakame added: “Recognising the challenges in securing funding of this magnitude, we are exploring modular development to reduce initial capital intensity, allowing us to phase expansion as financing becomes available.

“The group is actively engaging with investors, and discussions around robust funding structures are progressing well.”

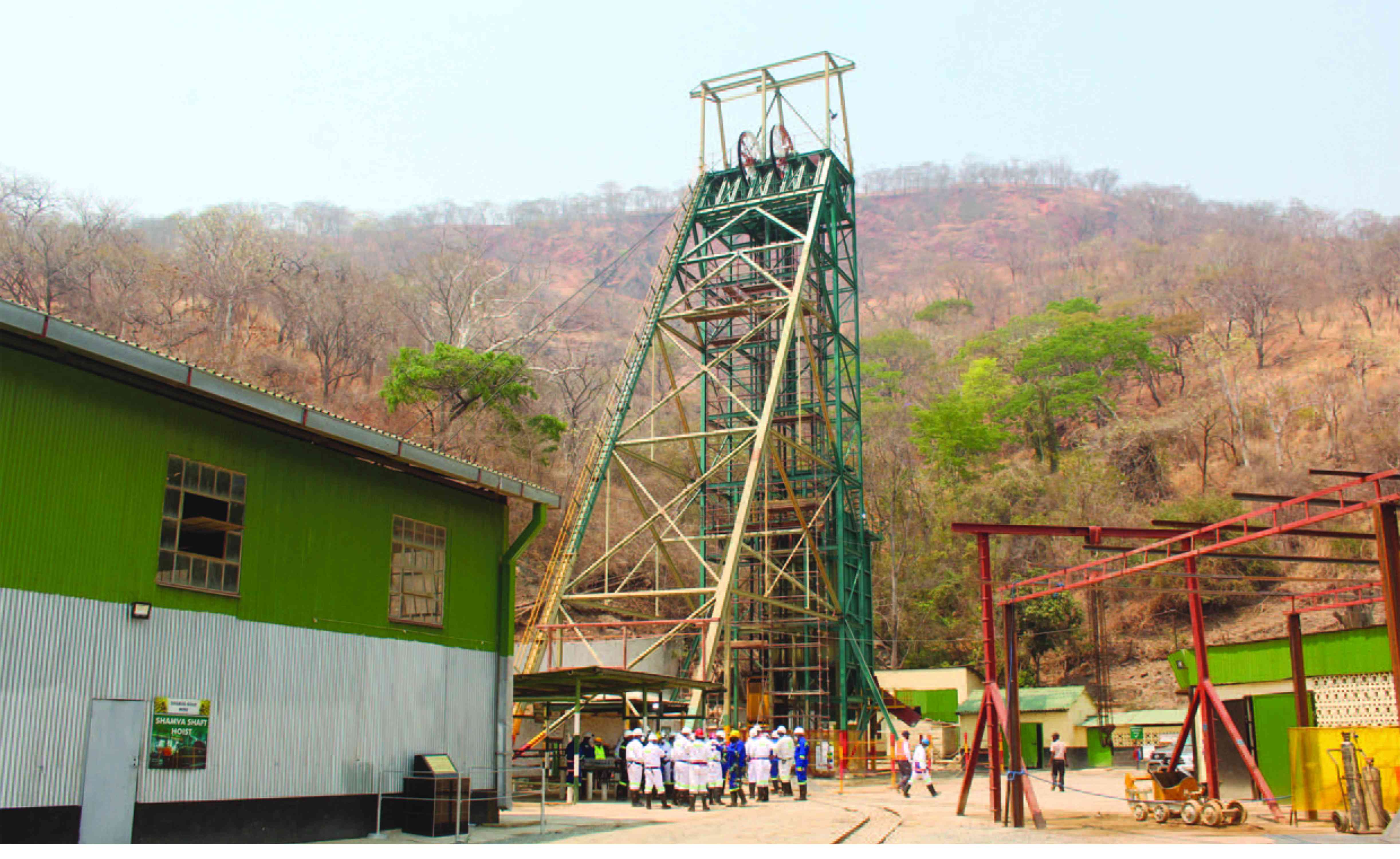

Shamva — one of Zimbabwe’s oldest gold mines — is producing 49 000 tonnes of ore per month from underground operations, a trajectory last achieved in 1910.

- ZimAlloys ready to switch on its biggest furnace

- Zisco deal gets Cabinet nod to sell iron ore

- Govt blocks US$400m platinum deal

- Kuvimba pumps US$100m into Great Dyke platinum project

Keep Reading

The mine, which also forms part of KMH’s gold cluster, together with two other active mines — Jena and Freda Rebecca, produced 3,6 tonnes of the yellow metal in the financial year ended March 31, 2025.

Freda contributed 68,3%, while Shamva and Jena accounted for 22,2% and 9,6% respectively.

“While we are optimistic about current market conditions, we are taking a measured approach — balancing growth opportunities with disciplined cost management to ensure long term sustainability,” he said.

“Looking ahead to the 2026 financial year, running from April 2025 to March 2026, our focus remains on modest production while prioritising front end loading for growth, particularly advancing the Shamva Hill open pit project.

“We aim to produce around 26 000 ounces, or just over 800kg, leveraging scalability from stay in business capital expenditure interventions. However, we remain mindful of cost containment.”

Mapakame said historical trends have shown that price surges can lead to operational overreach, eroding bargaining power with service providers and inflating costs. To mitigate this, the mining company will channel additional revenues into energy and process efficiencies, human capital optimisation, and projects that sustainably suppress unit costs.

The target for all in sustaining cost is approximately US$1 896 per ounce, slightly below last year’s figure of US$1 900.

In terms of capital expenditure, Shamva has budgeted almost US$8 million, a US$2 million increase from the previous financial year.

“Around 70% of this is allocated to stay in business capital expenditure, focusing on revitalising existing infrastructure, including equipment upgrades,” he said.

“The remaining 30% is earmarked for development capital, specifically front end loading for the Shamva Hill project. This includes exploration work to upgrade resources, such as converting inferred reserves into measured or indicated categories, as well as evaluation drilling in our underground complex.”

KMH has extensive interests in gold, nickel, lithium, chrome, and platinum.

It controls a number of assets, including Bindura Nickel Corporation, Great Dyke Investments, Sandawana Mine, Tiger and Club, Globe and Phoenix, Zimbabwe Alloys, among others.